It is only available in Cambodia. More information

Introduction to Seniority Payment in Cambodia

Seniority payment (in Khmer: ប្រាក់បំណាច់ចុងសន្សំ, often referred to as seniority indemnity) is a legally mandated employment benefit in Cambodia, designed to provide financial security and recognition to employees for their long-term service with an employer. It is governed primarily under the Labour Law of the Kingdom of Cambodia (1997, as amended) and relevant Prakas (ministerial regulations) issued by the Ministry of Labour and Vocational Training (MoLVT).

¶ 1. Purpose and Objective

The main purpose of seniority payment is to:

Reward employees for their loyalty and years of service.

Provide compensation in case of termination (except in cases of serious misconduct).

Ensure workers receive periodic financial benefits during employment, not just upon termination.

It reflects Cambodia’s efforts to strengthen worker protection, especially in line with ILO (International Labour Organization) standards.

¶ 2. Legal Framework

Seniority payment was officially introduced under:

Article 89 of the Cambodian Labour Law, and

Prakas No. 443 dated 21 September 2018 on Seniority Payment for Workers/Employees of Enterprises/Establishments Covered by the Labour Law.

This regulation replaced the older concept of “severance pay” in indefinite duration contracts (UDCs).

¶ 3. Applicability

Seniority payment applies to:

All employees under Undetermined Duration Contracts (UDC) in both the formal and informal sectors.

Both local and foreign employees working in Cambodia.

Employees under Fixed Duration Contracts (FDC) are not entitled to seniority payments but instead receive an end-of-contract indemnity (usually 5% of total wages).

¶ 4. Payment Structure

Seniority payment is made up of two parts:

¶ (a) Ongoing Seniority Payment

Paid twice per year: in June and December.

Each payment equals 7.5 days of average wages and benefits, making a total of 15 days per year.

¶ (b) Back Payment (for service before 2019)

Applicable to employees who worked before the implementation of Prakas 443.

Employers were required to pay back payments gradually for seniority accrued before 2019 (based on MoLVT instructions, often capped at a few years at a time).

¶ 5. Calculation Basis

Seniority payment is calculated based on:

Average wage: the average of the employee’s wages and benefits (excluding overtime and irregular bonuses) during the payment period.

Example:

If an employee’s monthly wage is USD 300, the semi-annual seniority payment is roughly:

300/30×7.5=75USD (each period).

¶ 6. Termination Scenarios

If the employee resigns voluntarily: seniority accrued but unpaid is typically forfeited unless otherwise agreed.

If terminated without serious misconduct: the employee is entitled to receive all accrued and unpaid seniority payments.

If terminated for serious misconduct: the employer is not required to pay remaining seniority

¶ How to calculate the seniority payment in AKAS

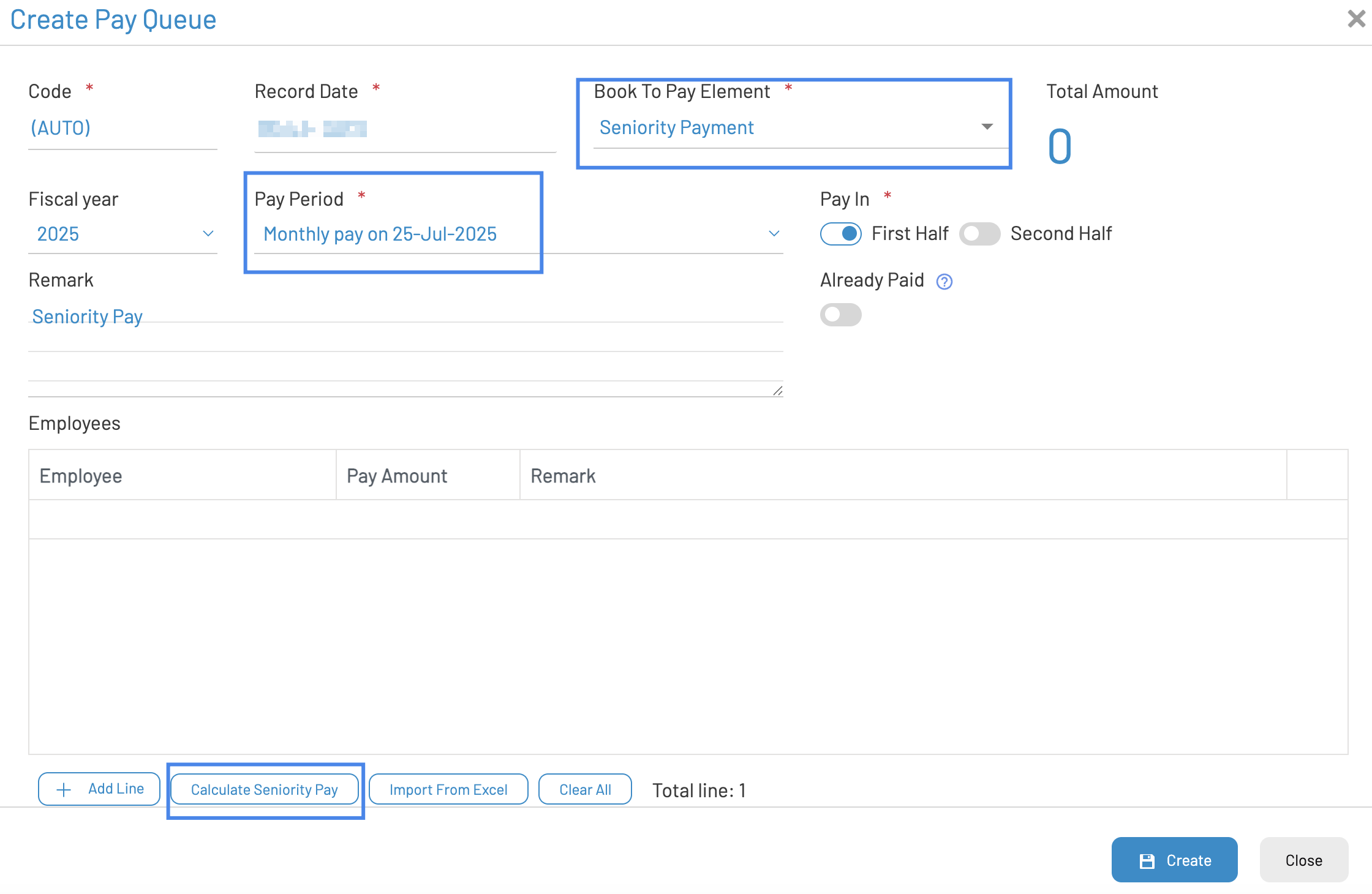

- Create a new pay queue

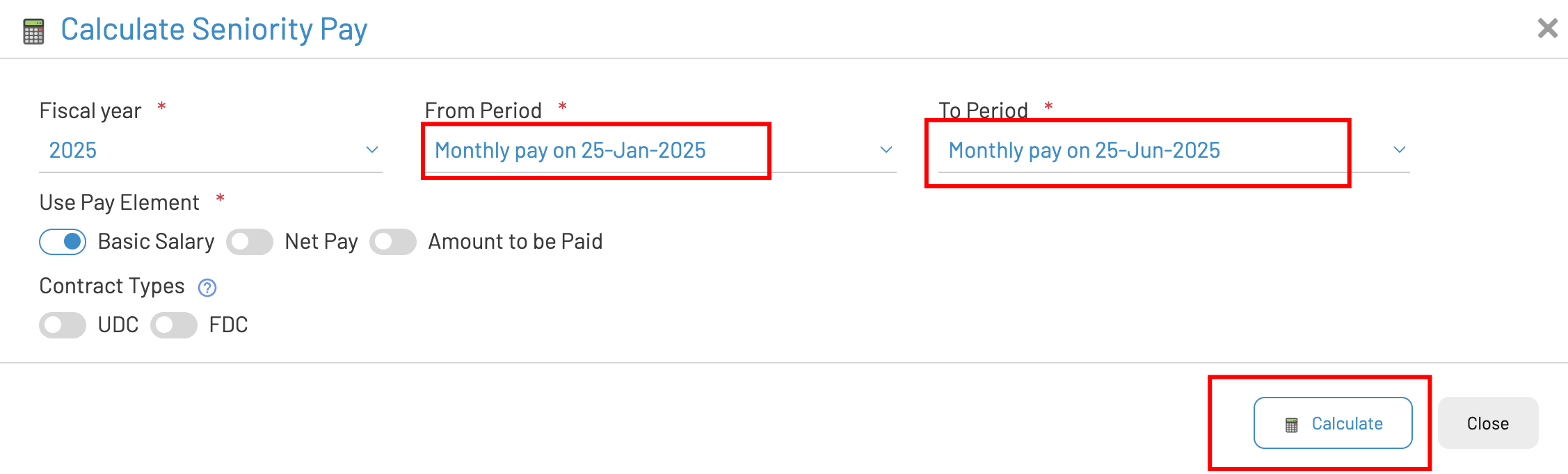

- Enter From Period and To Period (expected to be Jan to Jun if you are calculating seniority payment fro first 6 month of the year

- Click Calculate

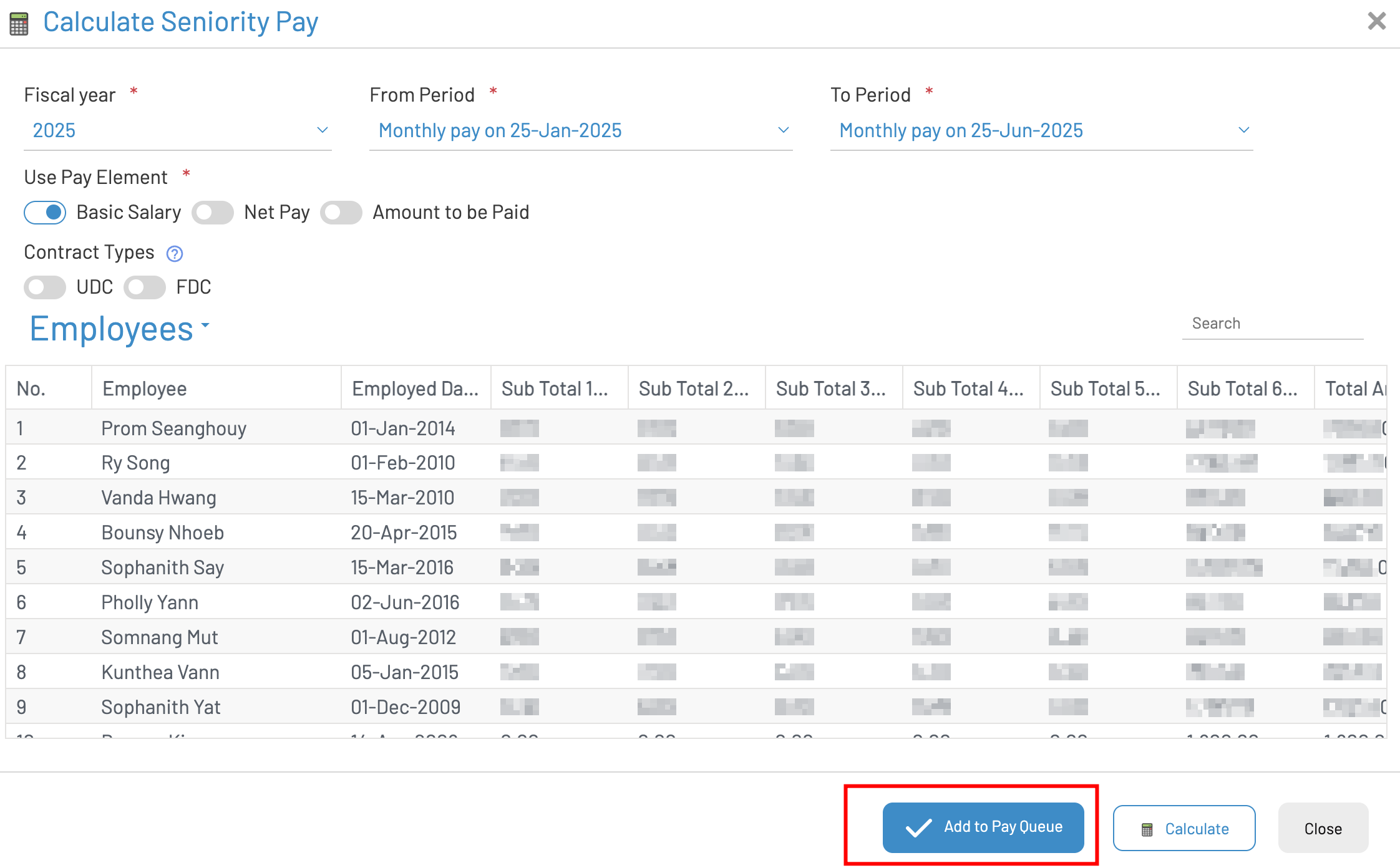

- Then click Add to Pay Queue.

Then save Pay Queue.